New York and California Each Lost $1 Trillion When Financial Firms Moved South

Aerial view of Miami, Florida. Joe Raedle/Getty Images

For the first time, hard data shows the scope of the upheaval

By Linly Lin and Tom Maloney

Graphics by Raeedah Wahid and Jade Khatib

August 21, 2023

The drip, drip, drip of the finance industry’s exit from New York and California has been measured anecdotally, one at a time, these past few years. Elliott Management decamped to West Palm Beach. AllianceBernstein to Nashville. Charles Schwab moved to suburban Dallas.

Now, for the first time, there are hard numbers quantifying the exact scope of the exodus. Both states have in the past three years lost firms that managed close to $1 trillion of assets, Bloomberg News calculated after going through corporate filings from more than 17,000 firms since the end of 2019.

The exodus from the Northeast and West Coast has meant the loss of thousands of high-paying jobs, straining city and state finances by sapping tax revenue. Commercial property markets have also lost valuable tenants at the same time they’ve been struggling with the new realities of hybrid work.

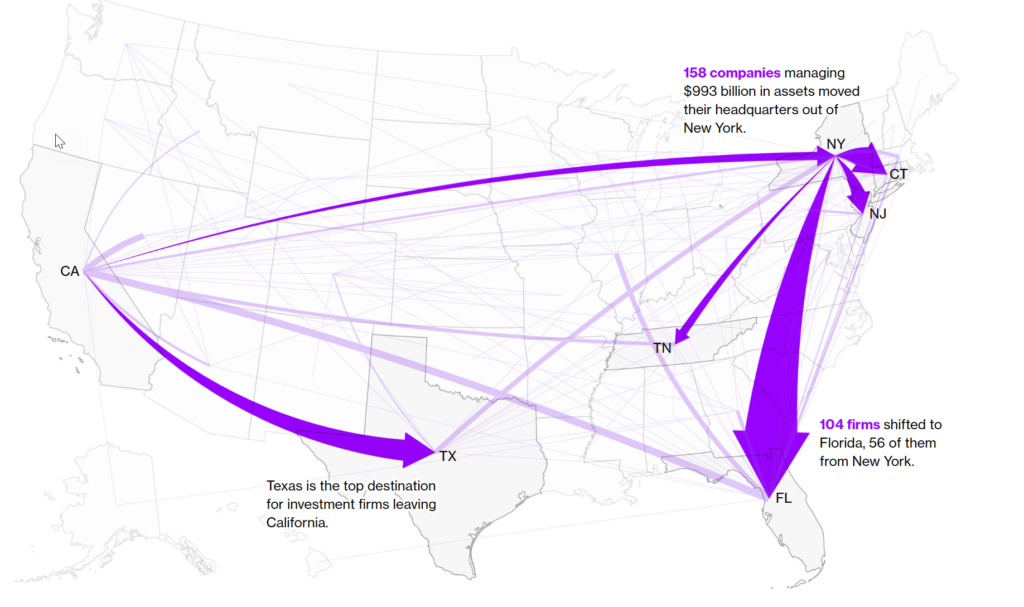

Investment Firms Are Moving to the Sun Belt

Headquarters relocations from Q1 2020 through Q1 2023

To be sure, the New York-area remains the most powerful center for asset management, but down south, the upheaval is fueling a boom. Miami’s house prices are soaring and a spate of new office buildings are under development. In Dallas, the finance industry is expanding at the fastest pace since the 1980s oil bust, with new campuses to accommodate thousands of employees for Goldman Sachs Group Inc. and Wells Fargo & Co. coming on the heels of Charles Schwab Corp.’s move to the area in 2020.

Investment Firms Left New York and California in Droves

Headquarters relocations from Q1 2020 through Q1 2023

https://www.bloomberg.com/toaster/v2/charts/211e741f616089ca46862711d906b686?hideLogo=true&hideTitles=true&web=true&

The moves, often born out of a desire for lower taxes, warmer weather and cheaper mansions, have pushed the industry’s footprint into parts of the US that previously didn’t have much of a finance presence beyond regional banks. It’s upending the economies of the hot new destinations, spurring plenty of angst in the places left behind, and creating new opportunities for investment professionals outside historic financial centers.

“The Sun Belt is continuing to change — no longer just a place of traditional industries like oil and gas, no longer just focused on tourism, or just focusing on the retirement community,” said Amy Liu, the interim president of the Brookings Institution and a researcher on urban policy. “These pandemic moves sort of reinforce that the major metros in these states are certainly becoming a destination for new industries.”

From the start of 2020 through the end of March 2023, more than 370 investment companies — about 2.5% of the US total, and managing $2.7 trillion in assets — moved their headquarters to a new state. The vast majority of the migration was out of high-cost-of-living locales in the Northeast and on the West Coast and into Florida, Texas and other Sun Belt refuges. North Carolina and Tennessee each added more than $600 billion in assets, mostly from just two relocations: AllianceBernstein to Nashville from New York in 2021 and Allspring Global Investment to Charlotte from San Francisco last year.

Firms Managing Billions in Assets Migrated South

Net change in total assets under management due to companies relocating from Q1 2020 through Q1 2023

https://www.bloomberg.com/toaster/v2/charts/7530bb17c00113dd8bc7f362d1ef002b?hideLogo=true&hideTitles=true&web=true&

Among the locales that experienced losses, Washington state saw just three firms leave during the period, but it sapped assets under management by 19% because one of the ones that departed was $211 billion money manager Fisher Investments. Connecticut, the hedge fund hub that’s long appealed to firms wanting to stay close to New York without being in the city, has now fallen behind Florida in assets under management.

Florida was the top destination for companies that left New York, with Icahn Capital Management and Cathie Wood’s ARK Investment Management among the most prominent to follow that path. Ken Griffin’s Citadel was the splashiest new arrival in Miami after it departed Chicago. Money manager DoubleLine headed to Tampa from suburban Los Angeles.

Weather and Low Taxes Draw Firms South

Headquarters relocations from Q1 2020 through Q1 2023

https://www.bloomberg.com/toaster/v2/charts/0543f3b55074ae30ca078c26a193a9b0?hideLogo=true&hideTitles=true&web=true&

For some of the newcomers, day-to-day life in the Sunshine State is radically different than what they left behind. Charles Hwang, who oversees $40 million of assets as chief investment officer at Lightning Capital, says he’s taken up fishing and even taught his kids to bait a hook since moving to Florida, which has meant a more suburban lifestyle with bigger dinner parties.

“In Manhattan, even if someone has a super large apartment, you can’t get like 10 families in very easily,” said Hwang, who moved with his family to West Palm Beach from New York in 2021. “In Florida you’re able to go to people’s homes. Several families will show up, and the kids can play in the pool while the parents are able to have conversations.”

Those leaving California tend to be less motivated by weather or having better access to the outdoors. The top destination for firms leaving the Golden State was Texas, which offers lower living costs and no state income tax. The benefits of moving to states that don’t levy an income tax was boosted when the Trump administration imposed limits on the SALT deduction that reduced the amount of state and local taxes that high income earners could deduct from their federal tax bill.

Mattie Parker, the Republican mayor of Fort Worth, said the presence of the region’s existing finance companies — firms including JPMorgan Chase & Co. and Fidelity Investments had offices there before the pandemic – has made it easier to lure newcomers.

“We feel really good about our financial services industry focus,” she said in an interview, adding that her pitch to companies considering a move focuses on quality-of-life issues. “They’re interested in moving to a place like North Texas, even from coastal cities where they’ve really been more well known for financial services.”

Taxes are far from the only lure for relocating companies, according to John Cummings, the chief administrative officer at Texas Capital Bancshares Inc. He moved to Dallas in January 2022 after working in finance in Manhattan for 30 years.

New York Leads in Office Count But Growth Stalls

States with the most investment firm headquarters

https://www.bloomberg.com/toaster/v2/charts/aa3ef4d1b3f24a4e7ee926ac4466d467?hideLogo=true&hideTitles=true&preventMobileFont=true&web=true&

“Qualitatively, I think the Texas business environment really is very optimistic,” he said. “It’s a really diverse economy now, it’s not entirely predicated on oil and gas. There’s obviously a significant amount of inflow of Fortune 500 companies. Talent tends to follow opportunity.”

For some in finance, leaving California and New York for a Republican-leaning state can be welcome. But for many others, it has the possibility to create discomfort, especially as Texas and Florida embrace right-wing policies toward migrants, restrict abortion, attack diversity initiatives and seek to impose restrictions on Chinese people buying property.

But many are flocking regardless, including as part of a relocation trend that precedes the pandemic — Baby Boomers, the wealthiest generation in human history, retiring to warmer climes in the South and Southwest. That’s creating new opportunities for money managers in the region, according to Ryan Luby, an associate partner at McKinsey & Co. who has studied the impact of hybrid work.

Investment advisers are simply following the money. The ritzy enclave of Palm Beach gained 37 firms compared to much bigger Miami’s 63. Florida also saw an additional 800 secondary offices set up by firms, more than any other state.

Investment Firms Flock to Miami and Tampa

Where firms opened headquarters in Florida, by city

https://www.bloomberg.com/toaster/v2/charts/578ea582a32471505a53e73cc55e6025?hideLogo=true&hideTitles=true&web=true&

Tiger 21, a worldwide network of more than 1,200 high-net-worth investors with assets totaling more than $150 billion, has seized on the migration to prop up its Florida chapter. One of the newer members, David Blumberg, moved from California at the end of 2020, settling down in oceanfront Golden Beach, a small city on a barrier island north of Miami. Blumberg, who embraces Florida’s Republican-leaning politics, said in his new home he’s able to be more open. “People don’t drop cocktail glasses at a party just because you said something.”

The things he misses?

“Chinese food,” Blumberg said. “I would also like some hills. If you could import a mountain range to Florida, that would be really good.”

Saul Martinez/Bloomberg

Some of the moves stemmed from the pandemic introducing finance folks to more relaxed lifestyles. People who fled the Northeast for the sunny weather of Florida when Covid-19 took off often ended up having to stay longer than expected when lockdowns were extended.

“They all came for two weeks, and now they’ve stayed for three years and they’re not going back,” said Nitin Motwani, a principal at real estate investment firm Merrimac Ventures in Fort Lauderdale and former trader at Goldman Sachs. Motwani says he’s met countless new residents who’ve made the spring break-to-permanent pandemic move to Miami.

He sees it as vindication for the several years he spent spearheading a push by the Miami Downtown Development Authority to persuade money managers to shift to the city, wooing decision-makers during the Art Basel festival in December, when it “was snowing everywhere else.”

“We would say, ‘Good news: This is Miami, this could be your life.’”

Even with the changes New York remains the clear leader in both the number and size of investment firms. The assets-under-management outflow since 2020 equals just a tiny fraction of the $25.6 trillion managed in the state, which is still 10 times as much as Florida has. Californian firms’ 2022 collective AUM was $15.7 trillion. And to be sure, most states — including California and New York — saw an increase in the total amount of assets managed there because of strong market performance.

Texas Gained the Most Investment Jobs From Incoming Firms

The largest net gains and losses in investment jobs due to relocating investment firmshttps://www.bloomberg.com/toaster/v2/charts/fbe811456fa79aa7ffa16c0fc33ddc27?hideLogo=true&hideTitles=true&preventMobileFont=true&web=true&

What those and other states lost might best be understood by looking at the gains in the South. The firms that moved to Texas brought with them more than 1,200 investment professionals, Tennessee added more than 1,000 and Florida added about 470. The numbers reflect individuals classified as traders, portfolio managers and other high-ranking decision-makers, some of whom would expect to earn seven or eight figures a year. The total number of people migrating — factoring in administrative workers, technical support folks and other support staff — would be significantly higher.

In the pre-pandemic days, firms were very cautious about moving outside of major financial hubs, worried that they would look unserious, according to Motwani.

“What’s happened since Covid is the opposite now,” he said. “Everybody loves the story, wants to be a part of the story and wants to tell everyone how great it is.”

It’s a sentiment echoed by Cummings, the Texas banker who moved from Manhattan.

“I’m not counting out New York for sure. It still is the financial center of the world,” he said. “But Dallas is a huge opportunity and yes, if I was young, I would encourage my younger self to come to Texas and see what I could make of myself.”

Methodology: Bloomberg News analyzed regulatory filings by US-registered investment advisory companies covering the years 2019 through 2022, available on the Securities and Exchange Commission’s website. Investment adviser firms that have registration exemptions, such as some family offices, very small hedge funds and certain venture capital funds, aren’t covered by this data.

Only a firm’s initial annual filing in each year was included in the analysis, to better capture a single point in time. The entire data set of more than 55,000 filings covers about 17,000 companies around the US.

When calculating the changes in the counts of investment professional positions resulting from company relocations by state, this analysis focused on roles that perform investment advisory functions only, excluding clerks, IT and other supporting staff.

Total assets under management (AUM) of firms fluctuate from year to year based on market performance. When calculating numbers based on AUMs, we used the reported data for 2022 as the base when discussing movements.

Relocations of sizable companies often take an extended period of time. The years during which companies moved mentioned in the article are based on the updates companies made to their regulatory filings.