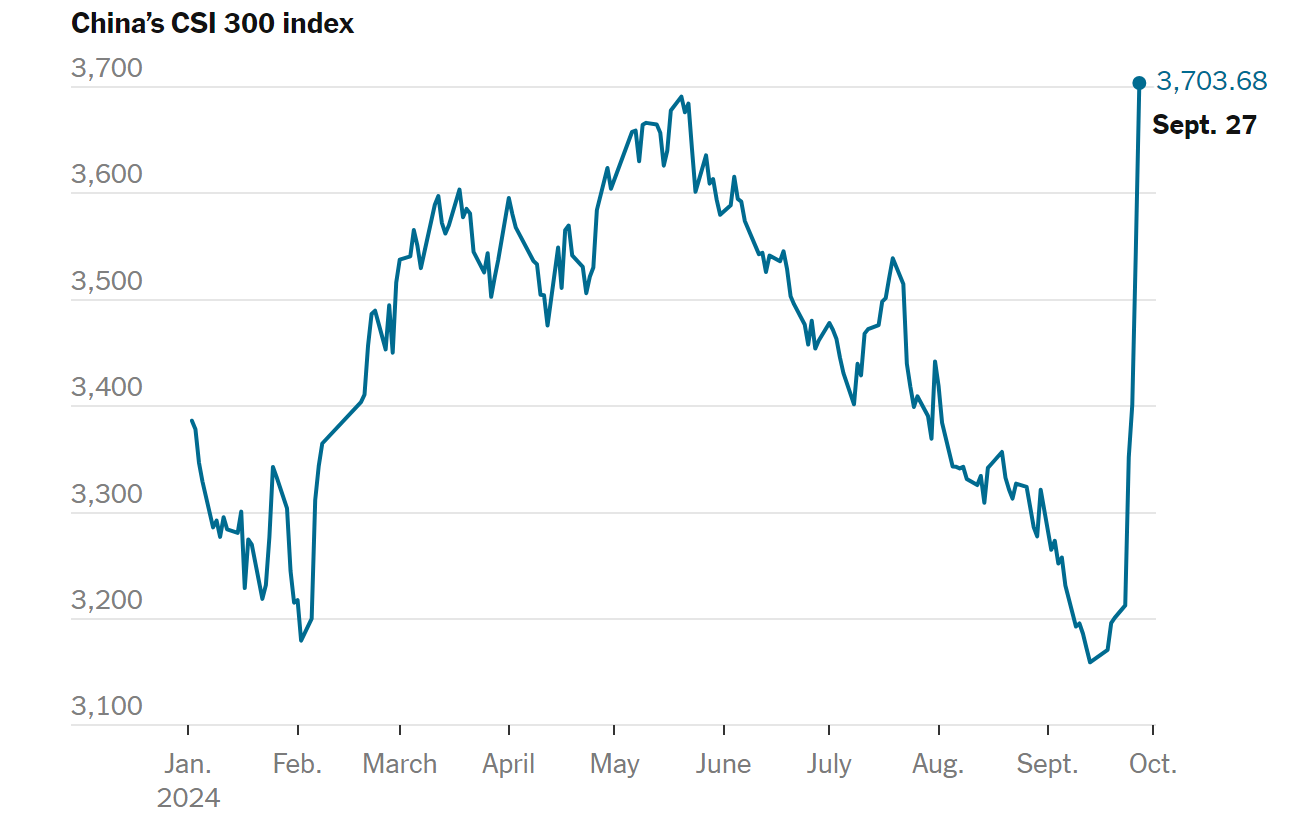

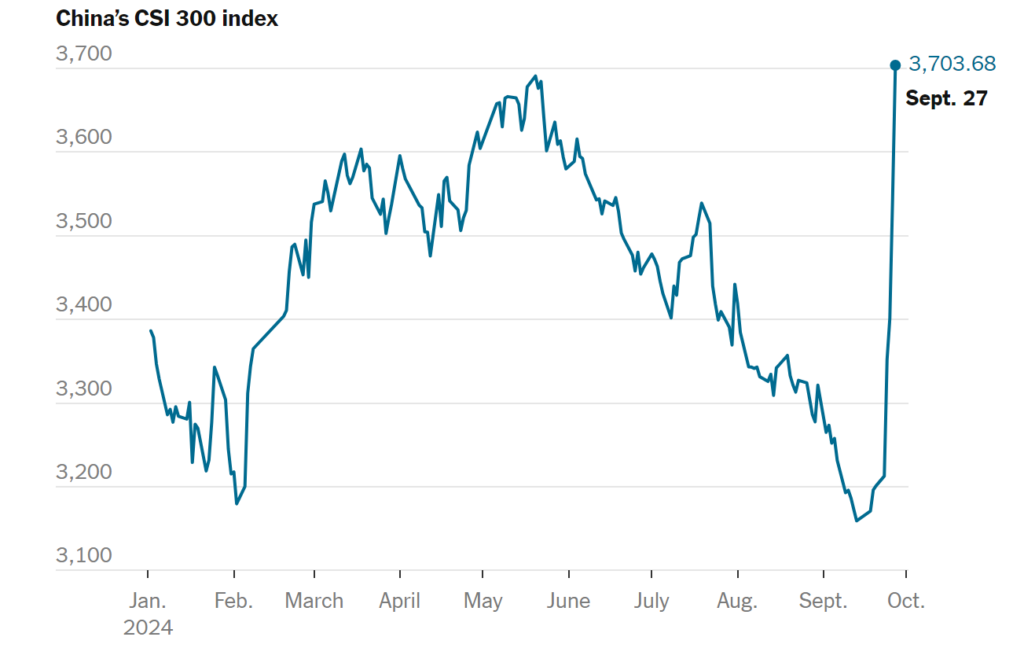

China Stocks Soar in Biggest Single-Week Jump Since 2008

On Friday, the CSI 300 index of big Chinese companies traded in Shanghai or Shenzhen rose 4.5 percent and was up 15.7 percent this week.

The gain was the largest in a single week for the index since November 2008, when share prices were gyrating violently with the onset of the global financial crisis.

The volatile Hang Seng Index in Hong Kong, which includes a range of companies with activities in Hong Kong and in mainland China, was also up 12.8 percent this week.

Sharp gains in China could shore up public confidence, at least temporarily, as the Chinese economy faces broadly falling prices, weak retail sales and a housing meltdown. The government has been trying to rebuild confidence to persuade consumers and home buyers to start spending money.

On Tuesday, China’s top financial regulators announced a package of measures, including interest rate cuts and requiring smaller mortgage down payments. One of the changes took effect on Friday: allowing commercial banks to lend a larger proportion of their assets.

Shares got a particular boost on Tuesday when regulators said at a news conference that banks would be allowed to lend heavily to companies to repurchase their shares, as well as to major shareholders to buy larger stakes in companies. Both moves could provide stronger financial support for stock purchases and help elevate share prices.

But Chinese stocks could now be set to surge even further as international investors start to pile in, Goldman Sachs said

Investing in the Chinese stocks or related country ETFs can offer significant opportunities, but it also comes with notable risks, such as economic slowdown or market volatility.

Global macro hedge funds offer several advantages compared to buying single stocks or ETFs:

1. Diversification

Global macro hedge funds invest across a wide range of asset classes and geographical regions, including stocks, bonds, currencies, and commodities. This diversification helps spread investment risk and can potentially enhance returns by capitalizing on opportunities in different markets and sectors.

2. Flexibility and Adaptability

These funds employ a top-down investment approach, focusing on macroeconomic factors and political events to make investment decisions. Fund managers have the flexibility to adapt to changing market conditions, which allows them to take advantage of emerging opportunities and mitigate risks.

3. Absolute Returns

Global macro hedge funds aim to deliver positive returns regardless of the broader market environment. This characteristic can be particularly attractive during periods of economic uncertainty or market volatility when traditional investments may struggle to generate positive returns.

4. Sophisticated Risk Management

These funds often employ advanced risk management techniques to protect investor capital during turbulent market conditions. This can include using derivatives to hedge against potential losses and leveraging various financial instruments to manage risk effectively.

5. Capital Efficiency

Global macro hedge funds can use derivatives to gain exposure to different markets with a relatively low amount of capital. This allows them to maintain most of their capital in instruments that earn a cash yield, potentially enhancing overall returns.

Rosestone Partners LP, A Global Macro Hedge Fund managed by Wen Futures Capital Management