Rate Cuts Won’t Save Real Estate

Investors are coming to the realization that the Fed’s journey down the monetary policy stairs may not bolster the ailing real estate

sector, with long-end yields remaining elevated despite the central bank’s jumbo rate reduction last week. Against this backdrop, the

Treasury curve is steepening sharply as bond vigilantes smell an inflation problem down the road and remain unwilling to lock in the

coupons of the day. Today’s economic calendar provided further evidence of costly duration, with the pace of new home sales

declining and inventories increasing as builders relied on discounts to support transactions.

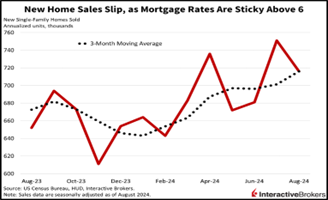

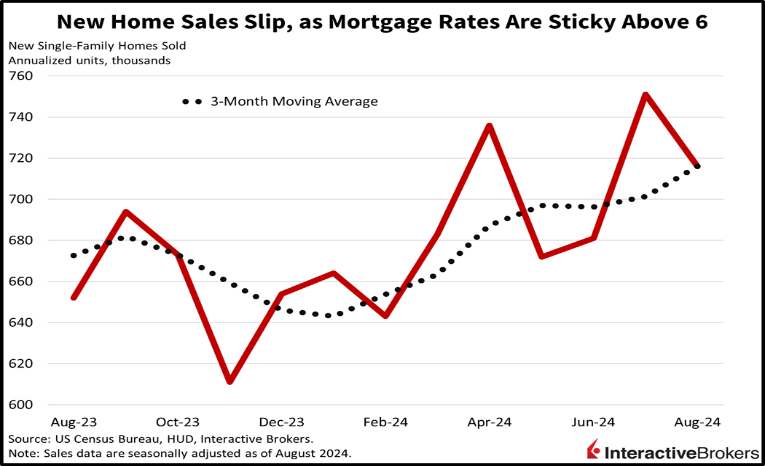

Sales of New Builds Slip

The pace of new home sales slipped last month on weakness across most of the country, as elevated prices and towering mortgage

rates continued to hamper affordability. Transactions for fresh builds fell to 716,000 seasonally adjusted annualized units, a 4.7%

month over month (m/m) slip from July. However, August’s figure did beat the median estimate of 700,000. Volumes were weakest

in the Northeast, West and Midwest with the m/m stride of closings decreasing 27.3%, 17.8% and 5.8% while the South provided a

modest offset, increasing 2.7% during the period. Inventories grew last month, indicated by the amount of supply relative to the rate

of current monthly sales, which rose to 7.8 from 7.3 in July. Finally, the median and average sales prices dropped to $420,600 and

$492,700 from $429,000 and $508,200, respectively.